I had James Delingpole, the right-wing journalist and blogger in one of my classes today. He described himself as an Austrian School, free market libertarian and soon lived up to his billing. Debate ranged from HS2 and NHS, to cutting the deficit and quantitative easing but we settled for a fair while on the energy industry and what he considers to be the worst 2 words in the English language - Renewable Energy.

According to James, wind farms are an example of unproductive enterprise - he compared them to the digging holes and paying someone to fill them in, as in the great depression. In fact, he claims, that on-shore wind farms have a 100% subsidy and off-shore a 200% subsidy. All we are doing is paying over the odds for our energy. I'm not sure where those figures are from but it is certainly true that the subsidies paid are very high but I can't agree that this is simply pouring money down the drain, or giving them an unfair advantage.

It is true that there are problems with wind power - they only operate on average about 75-80% of the time but changing wind speed means that they only produce about 30% of their theoretical capacity. This sounds poor but is is better than many other forms of renewable energy and even conventional power stations only average about 50% of their capacity. Then there are all the problems of transporting energy from remote wind farms to where it is needed. Much of the power is generated at times of low usage, such as at night, and it cannot really be stored, etc. etc. The costs and difficulties associated with wind power are clear but that doesn't mean that subsidies are unfair or wasted.

The costs of wind power may be clear, but the costs of fossil fuel generation are not. Some, the private costs of the fuel and labour for example are obvious but many of the external costs that the power generator does not have to pay for are not. We miss the cost of the acid rain, the visual pollution, the congestion created on road, rail or waterway by transporting the coal, the damage caused by huge gas pipelines. We ignore the risk of generating 60% of our energy through natural gas, much of which comes to us through a narrow sea lane between Iran and the UAE. All of these costs fall on people living near the power station but not on the company them selves. In Economics we call this an externality. A situation where some of the costs of production/consumption fall on people other than the producer/consumer.

Taxing more polluting methods of electricity production in order to subsidise greener methods, which is in effect what we are doing, simply levels the playing field, making up for all those hidden costs which we don't see. We refer to it as internalising the externality as now consumers make a choice based on the full costs of their actions. There it is, a justification for renewable energy and I haven't even mentioned the effects of CO2 emissions and the effect off man made global warming, which James denies... Oops.

So the price of domestic gas and electricity are rising faster than wholesale prices. It must be a rip-off. Well, to quote Ben Goldacre, I think you'll find it is a bit more complicated than that.

The wholesale price is just one of the energy firm's costs. They also need to pay the national grid to transport it, subsidise government initiatives to reduce energy usage and promote green power, pay workers, tax etc. High prices are not necessarily a sign that the market has failed, it could simply be the price mechanism efficiently rationing a scarce resource. So are we being ripped off? Let's have a look at some of the evidence.

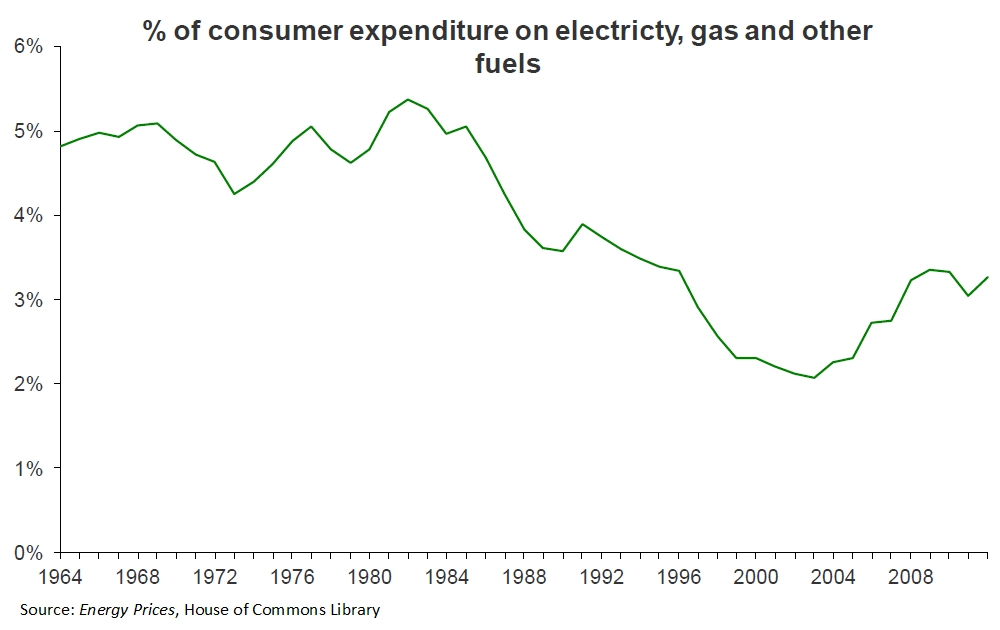

Most people are far more concerned about the affordability of their energy bills than the actual number, which is affected by inflation anyway and so hard to compare year after year. It is perhaps more helpful to consider energy costs as a proportion of household income. As you can see, while households are spending a bigger chunk on energy than a few years ago, that was unusually low. compared with the long term trend, we are spending less of our income than we might expect.

Most people are far more concerned about the affordability of their energy bills than the actual number, which is affected by inflation anyway and so hard to compare year after year. It is perhaps more helpful to consider energy costs as a proportion of household income. As you can see, while households are spending a bigger chunk on energy than a few years ago, that was unusually low. compared with the long term trend, we are spending less of our income than we might expect.

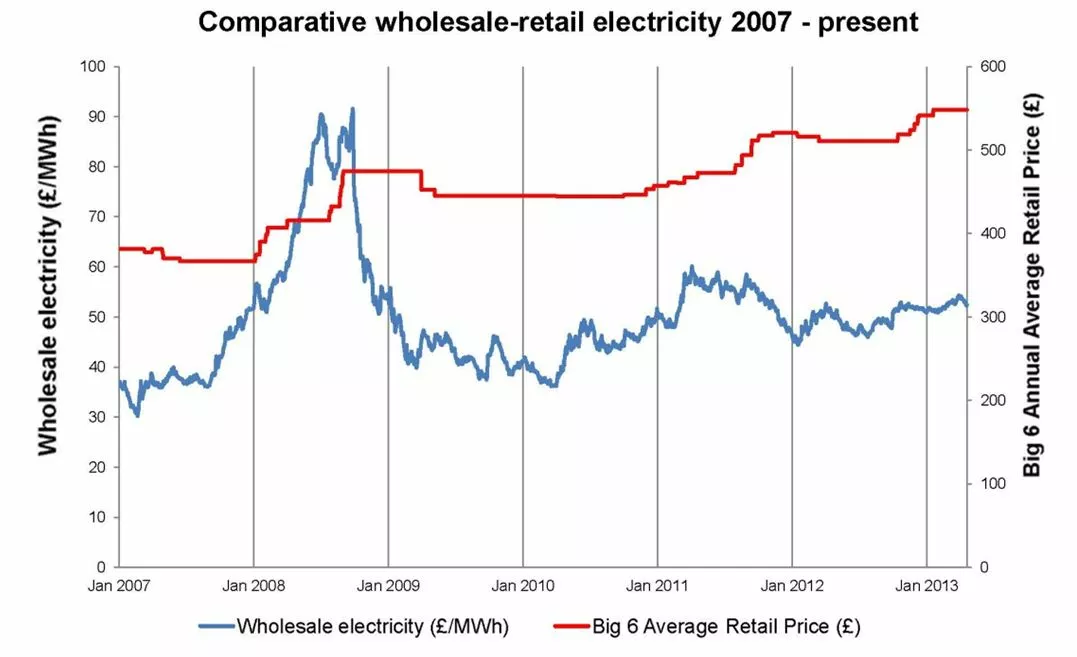

This has been much talked about and rightly so. The cost to the providers of purchasing electricity and gas on world markets are rising but not by nearly as much as the retail prices that consumers in the UK pay. It is also clear from the data that retail prices for electricity do rise with wholesale cost but tend to fall much more slowly, if at all. The picture is very similar for gas.

Wages cannot be a major factor in the current price rises. Average wages are stagnant of falling in real terms and with stubbornly high unemployment it is unlikely that they will be rising fast any time soon. The fees paid by providers to the national grid have risen quite significantly, as much as 10% a year in some areas but use of the national distribution network only accounts for about 2% of total costs. The much talked of Green Energy charges do also add to bills but this has been estimated to only account for 5-8% in total.

Many have argued that the true reason for the price rises is the lack of competition. The Big Six energy firms control 90% of the domestic market between them. They have been accused of opaque pricing with dozens of different tariffs further complicated by discounts for paperless billing etc. Even price comparison sites struggle. All 4 price comparison sites I tested for this article recommended a different supplier and offered a different saving even when given exactly the same information.

Economic theory suggests that oligopolistic markets such as the UK energy market will not complete on price and this certainly seems to be the case with firm after firm announcing similar price rises, year after year. This has prompted the Prime Minister to launch an inquiry into industry.

The cause of the price rises is a bit more complicated than the news papers might let on but it does seem that wholesale prices and the costs of green policies alone don't fully explain the £3.7bn profits generated by the Big Six last year, or the fact that this figure is up 73% since 2009.