Updated 50-30-20 Budget Calculator

Your Budget Allocation

Why This Matters

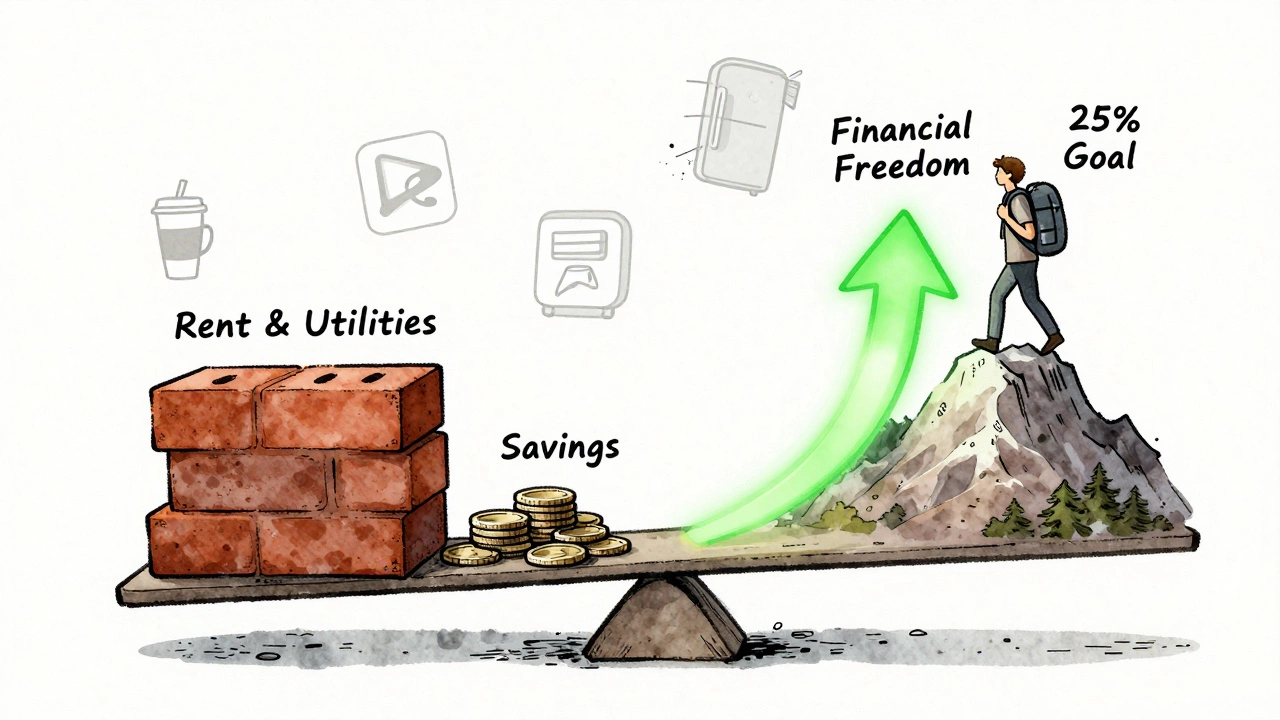

The updated rule accounts for 2026 realities: rising housing costs (42% since 2020), inflation (18% purchasing power loss), and healthcare needs. This tool helps you allocate funds realistically for needs (45%), wants (30%), financial goals (25%), and a 5% buffer for surprises.

Your Allocation

Note: Needs include housing, utilities, groceries, basic healthcare, public transport, minimum debt payments, and essential childcare.

Pro Tip: Even if you can't save 25%, start with what you can. Every €20 saved builds momentum.

Most people think the 50-30-20 rule is just a simple split: half your income goes to needs, three-tenths to wants, and two-tenths to savings. But if you’re living in 2026, that old formula doesn’t cut it anymore. Rent in Dublin has jumped 42% since 2020. Groceries? Up 31%. And if you’re trying to save for a home, a car, or even just an emergency fund, the numbers don’t add up. The 50-30-20 rule was never meant to be a rigid law-it was a starting point. Now, it needs an update.

Why the Old 50-30-20 Rule Falls Apart Today

Back in the 2000s, when the rule was popularized by Senator Elizabeth Warren, the average American household spent about 35% of income on housing. Today, in cities like Dublin, London, or even smaller towns, that number hits 50% or more for renters. If you’re paying €1,800 a month for a one-bedroom flat, and you earn €3,500 net, you’re already over the 50% limit before you even buy groceries or pay your phone bill.Then there’s healthcare. In Ireland, while public services exist, many people pay for private insurance, dental care, or prescription top-ups. That’s not a ‘want’-it’s a necessity. But under the old rule, those costs get lumped into the 50% bucket, leaving little room for actual needs like heating, transport, or childcare.

And savings? The 20% rule sounds generous until you realize inflation has eaten 18% of your purchasing power since 2020. If you saved €700 a month five years ago, it’s worth €570 today. That’s not building wealth-it’s just keeping pace.

The Updated 50-30-20 Rule for 2026

Here’s what actually works now:- 45% for Needs - Rent, utilities, groceries, basic healthcare, public transport, minimum debt payments, and essential childcare. This is the bare minimum to survive without stress.

- 30% for Wants - Dining out, subscriptions, hobbies, clothes, travel, entertainment. This isn’t about guilt-it’s about living.

- 25% for Financial Goals - This replaces the old 20%. It includes savings, investments, debt payoff beyond minimums, and retirement contributions. Why 25%? Because inflation and housing costs mean you need to save more just to stay in place.

- 5% buffer for surprises - A new category. Life doesn’t follow budgets. A broken fridge, a medical co-pay, a car repair-these aren’t wants or needs. They’re unexpected. That 5% is your shock absorber.

This isn’t just a tweak. It’s a shift in mindset. The old rule assumed stable costs and low inflation. The new one assumes volatility. It’s designed for people who are tired of choosing between paying the heating bill and putting money aside.

How to Apply the Updated Rule Step by Step

Start with your net income-the money that lands in your account after tax and pension deductions. That’s your baseline.

- Track every expense for one month. Use a free app like Moneyhub or even a simple spreadsheet. Don’t guess-record every coffee, every bus ticket, every online subscription.

- Categorize each expense. Is it a need? A want? Or a financial goal? Be honest. That monthly Netflix subscription? Want. That mandatory health insurance? Need. That €50 transfer to your savings account? Financial goal.

- Adjust your spending to fit the new percentages. If you’re spending 60% on needs, find where you can trim. Can you switch to a cheaper mobile plan? Use public libraries instead of paid streaming? Walk or cycle instead of taking taxis?

- Automate your 25% financial goal. Set up a direct debit to a separate savings or investment account. Do it the day after payday. Out of sight, out of mind.

- Review every three months. Your income might change. Rent might go up. A bonus might come in. The rule isn’t set in stone-it’s a living tool.

One woman in Limerick, Maria, earns €3,200 a month. Before the update, she was trying to follow the old rule. She spent €1,700 on rent, €400 on groceries, €250 on utilities, and €200 on insurance. That’s €2,550-79% of her income on needs alone. She had nothing left for savings. After switching to the updated rule, she cut her phone plan, switched to a cheaper supermarket, and started using the local food co-op. She freed up €200 a month. She moved €150 to savings and kept €50 as her buffer. Within six months, she had €1,200 saved. Not because she earned more-because she spent smarter.

What This Rule Doesn’t Cover

The updated 50-30-20 rule doesn’t fix systemic problems. It won’t lower rent. It won’t fix underpaid jobs. But it gives you control over what you can control. It’s not about being perfect. It’s about being aware.

If you’re working two jobs just to keep up, this rule won’t magically give you more time. But it will help you see where your money is leaking. Maybe you’re paying €120 a month for a gym you never use. Maybe you’ve got three streaming services you don’t watch. Maybe you’re buying coffee every morning because you’re too tired to make it at home. Those small leaks add up.

This rule also doesn’t replace professional financial advice. If you’re in debt, struggling with mental health, or dealing with an unstable income, talk to a free service like Money Advice and Budgeting Service (MABS). They’re not here to judge-they’re here to help you rebuild.

Common Mistakes People Make

Here’s what goes wrong when people try this:

- Calling everything a ‘need’ - That new smartphone because your old one is ‘slow’? That’s a want. Your phone bill is a need. The device isn’t.

- Ignoring the buffer - Life happens. Without that 5%, one unexpected bill derails your whole plan.

- Waiting for ‘the right time’ to start - You don’t need to wait for a raise. Start with what you have now. Even €20 a month into savings builds momentum.

- Comparing yourself to others - Your neighbour might have a bigger house, but they’re also drowning in debt. Your progress is yours alone.

Who This Rule Works Best For

This updated version is for adults who are:

- Working but not getting ahead

- Feeling stuck between paying bills and saving for the future

- Trying to escape debt or build a safety net

- Looking for a simple, no-fluff system that doesn’t require financial degrees

If you’re retired, on a fixed income, or self-employed with irregular pay, this rule needs adjustments. But the core idea still applies: know where your money goes, protect your future, and give yourself room to breathe.

What Comes Next?

Once you’ve got the updated 50-30-20 rule running smoothly for six months, you can start thinking bigger. Maybe you want to invest in a low-cost index fund. Maybe you want to pay off your credit card. Maybe you want to start a side hustle. But those are next steps. First, master the basics.

Money isn’t about restriction. It’s about freedom. The updated rule doesn’t take away your coffee or your weekend trips. It just makes sure you’re not paying for them with your future.

Is the 50-30-20 rule still valid in 2026?

The original 50-30-20 rule is outdated for most people in 2026. With soaring housing costs, inflation, and stagnant wages, the old split doesn’t leave room for savings or emergencies. The updated version adjusts needs to 45%, keeps wants at 30%, increases savings to 25%, and adds a 5% buffer for unexpected expenses. This version is realistic for today’s economy.

What if my rent is more than 50% of my income?

If your rent is over 50%, you’re not failing-you’re in a tough situation. Focus on the 25% financial goal first. Even if you can’t reduce rent right away, cut non-essentials in your wants category. Look into housing assistance programs like the Housing Assistance Payment (HAP) or rent supplement. Talk to MABS. Your goal isn’t to fit the rule perfectly-it’s to protect your financial future while you work on long-term solutions.

Should I include pension contributions in the 25%?

Yes. Any money you put toward retirement-whether it’s your employer’s pension scheme, a PRSA, or a personal savings plan-counts toward the 25% financial goal. This includes both your contributions and your employer’s matching payments. Retirement isn’t a want. It’s a financial goal.

Can I use this rule if I’m self-employed?

Yes, but you need to adjust for income variability. Use your average monthly income over the last 6-12 months as your baseline. Set up automatic transfers to savings on the same day you get paid, even if the amount changes. Keep a cash reserve of 3-6 months of expenses to cover lean months. The 5% buffer becomes even more critical for freelancers and gig workers.

What if I have high debt?

If you’re paying high-interest debt (like credit cards), treat paying it off as part of your 25% financial goal. You might need to temporarily reduce your savings goal to focus on debt. Once the debt is gone, redirect that money back into savings. The goal isn’t to save and pay debt at the same time-it’s to eliminate the debt that’s eating your future.

Final Thought: It’s Not About Perfection

The updated 50-30-20 rule isn’t a magic fix. It won’t make you rich overnight. But it gives you clarity. It turns abstract stress into concrete actions. You don’t need to be perfect. You just need to be consistent. One month at a time. One decision at a time. That’s how real financial change happens.