So the price of domestic gas and electricity are rising faster than wholesale prices. It must be a rip-off. Well, to quote Ben Goldacre, I think you'll find it is a bit more complicated than that.

The wholesale price is just one of the energy firm's costs. They also need to pay the national grid to transport it, subsidise government initiatives to reduce energy usage and promote green power, pay workers, tax etc. High prices are not necessarily a sign that the market has failed, it could simply be the price mechanism efficiently rationing a scarce resource. So are we being ripped off? Let's have a look at some of the evidence.

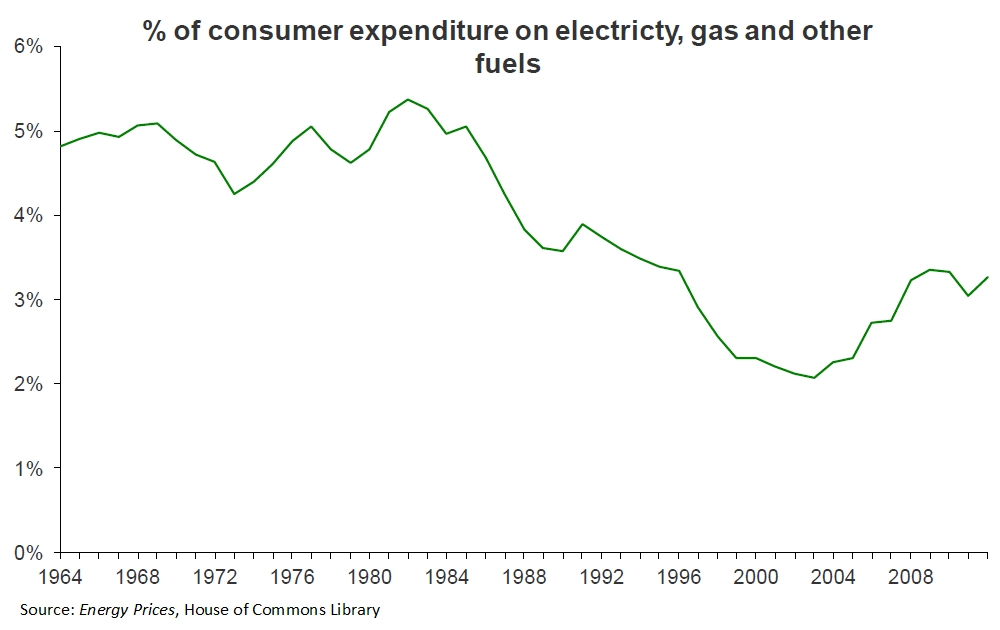

Most people are far more concerned about the affordability of their energy bills than the actual number, which is affected by inflation anyway and so hard to compare year after year. It is perhaps more helpful to consider energy costs as a proportion of household income. As you can see, while households are spending a bigger chunk on energy than a few years ago, that was unusually low. compared with the long term trend, we are spending less of our income than we might expect.

Most people are far more concerned about the affordability of their energy bills than the actual number, which is affected by inflation anyway and so hard to compare year after year. It is perhaps more helpful to consider energy costs as a proportion of household income. As you can see, while households are spending a bigger chunk on energy than a few years ago, that was unusually low. compared with the long term trend, we are spending less of our income than we might expect.

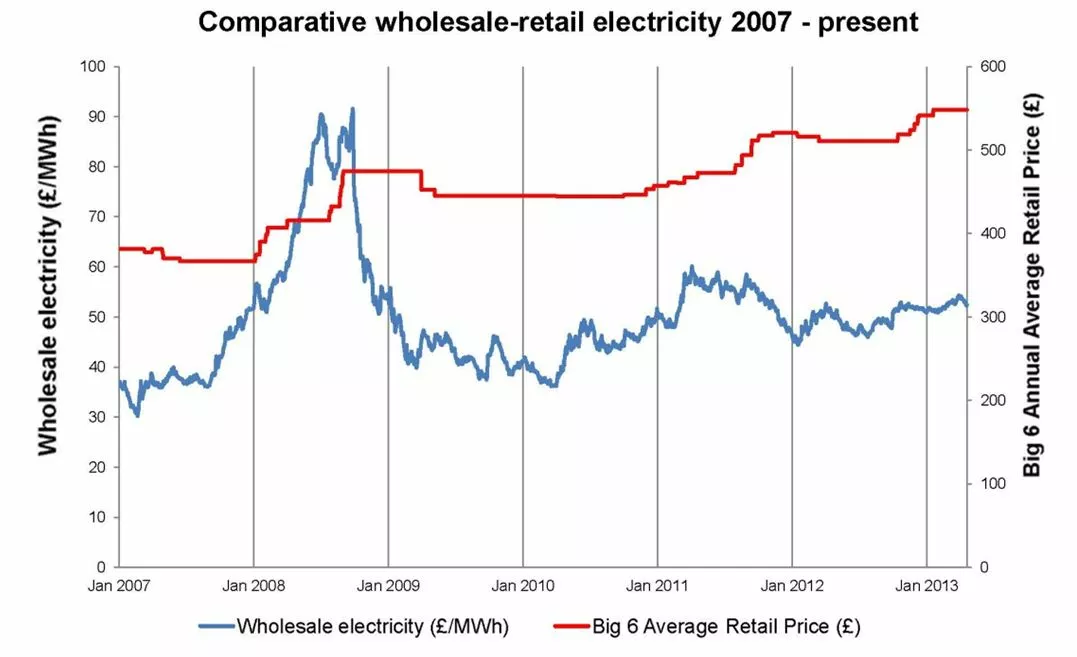

This has been much talked about and rightly so. The cost to the providers of purchasing electricity and gas on world markets are rising but not by nearly as much as the retail prices that consumers in the UK pay. It is also clear from the data that retail prices for electricity do rise with wholesale cost but tend to fall much more slowly, if at all. The picture is very similar for gas.

Wages cannot be a major factor in the current price rises. Average wages are stagnant of falling in real terms and with stubbornly high unemployment it is unlikely that they will be rising fast any time soon. The fees paid by providers to the national grid have risen quite significantly, as much as 10% a year in some areas but use of the national distribution network only accounts for about 2% of total costs. The much talked of Green Energy charges do also add to bills but this has been estimated to only account for 5-8% in total.

Many have argued that the true reason for the price rises is the lack of competition. The Big Six energy firms control 90% of the domestic market between them. They have been accused of opaque pricing with dozens of different tariffs further complicated by discounts for paperless billing etc. Even price comparison sites struggle. All 4 price comparison sites I tested for this article recommended a different supplier and offered a different saving even when given exactly the same information.

Economic theory suggests that oligopolistic markets such as the UK energy market will not complete on price and this certainly seems to be the case with firm after firm announcing similar price rises, year after year. This has prompted the Prime Minister to launch an inquiry into industry.

The cause of the price rises is a bit more complicated than the news papers might let on but it does seem that wholesale prices and the costs of green policies alone don't fully explain the £3.7bn profits generated by the Big Six last year, or the fact that this figure is up 73% since 2009.

Traditionally we assume that firms aim to profit maximise. For a perfectly competitive firm this will be true as they have no choice but monopolies are price makers and so could theoretically choose a point other than profit maximisation.

Monopolies feature at AS but at A Level you need to be able to draw a costs and revenues diagram to show the effect on price, quantity and efficiency. This presentation will take you through calculating the costs and revenues through to the diagram and the impact on welfare.