The economic cycle refers to the regular pattern of growth and then slowdown or recession seen in most market economies.

There are 4 phases to the economic cycle:

Recession – two consecutive quarters of negative economic growth

Slump – the economy has stopped contracting but has not yet started to grow

Recovery – growth has returned and employment is starting to rise again

Boom – strong economic growth associated with very low unemployment and rising inflation.

There are a number of possible causes of these economic cycles:

Inventory Cycles – When firms have excess stocks they may wish to de-stock, cutting back on output and so workers. This will reduce demand as incomes have fallen, further reducing the need for output. Equally when firms expect rising demand they will want to increase stocks and so will need a large increase in output.

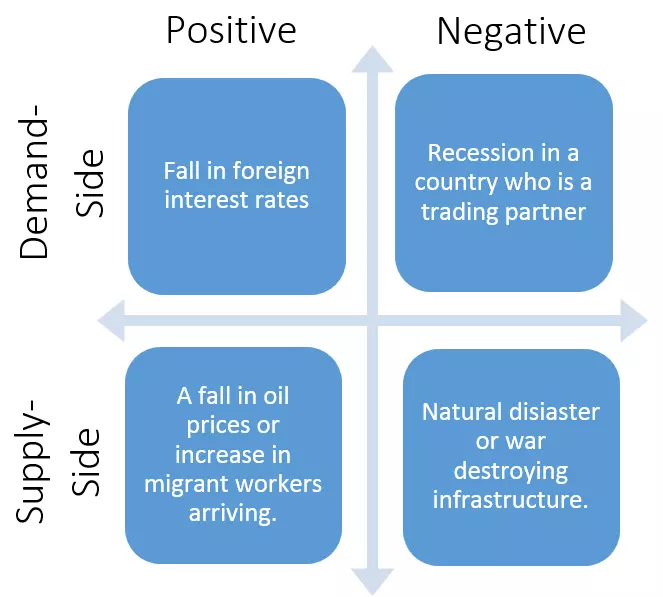

Outside shocks – unexpected events altering either aggregate demand (demand side shocks) or aggregate supply (supply side shocks) can cause an increase or decrease in output.

Political Cycles – recessions and slowdowns have often closely followed elections. This suggests that governments may be creating unsustainable growth before an election in order to remain in power but that this leads to tightening of monetary and fiscal policy after the election. The long period of growth after independent Bank of England gained responsibility for monetary policy lends weight to this suggestion.

Accelerators and Multipliers – an injection into the circular flow leads to a multiplier effect, creating an increase in growth. A growth in national income will also lead to an accelerator effect, increasing investment spending. This also works in reverse if there is a withdrawal from the circular flow. This would create a sustained upturn followed by a sustained recession.